All About Loss Adjuster

Table of ContentsTop Guidelines Of Property DamageUnknown Facts About Loss AdjusterThe Main Principles Of Property Damage

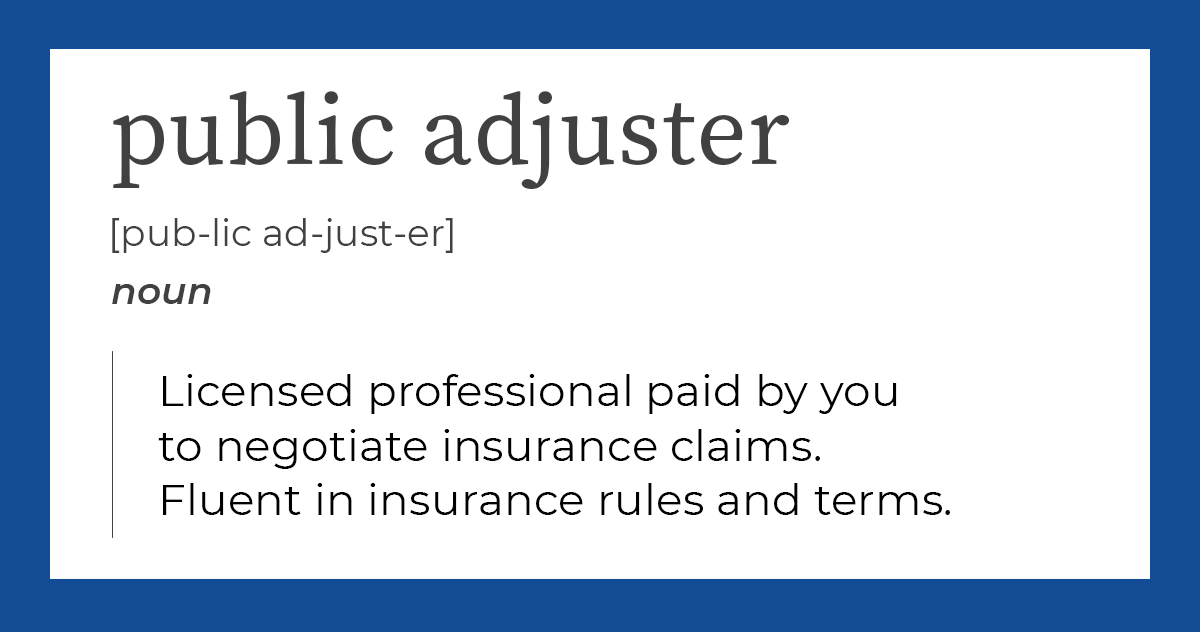

A public insurer is an independent insurance policy professional that an insurance policy holder might work with to help work out an insurance policy case on his or her behalf. Your insurance provider supplies an adjuster at on the house to you, while a public insurance adjuster has no relationship with your insurer, and also bills a charge of as much as 15 percent of the insurance coverage negotiation for his/her services.

If you're considering employing a public adjuster: of any public adjuster. Request referrals from family members and also partners - public adjuster. Make certain the insurer is accredited in the state where your loss has actually taken place, and also call the Bbb and/or your state insurance division to check out his or her document.

Your state's insurance policy department may establish the portion that public insurance adjusters are allowed cost. Watch out for public insurers that go from door-to-door after a disaster. property damage.

Savings Contrast rates and also conserve on residence insurance policy today! When you file a case, your house owners insurance policy firm will designate a claims insurer to you.

Little Known Questions About Property Damage.

Like a cases insurance adjuster, a public insurance adjuster will certainly examine the damages to your home, assistance establish the scope of repair services and approximate the replacement worth for those repair services. The huge distinction is that rather than working on behalf of the insurance provider like an insurance declares insurer does, a public cases insurer benefits you.

The NAPIA Directory site lists every public adjusting firm needed to be certified in their state of operation (loss adjuster). You can enter your city and also state or ZIP code to see a listing of insurance adjusters in your location. The various other method to locate a public insurance coverage insurer is to obtain a referral from close friends or relative.

Most public insurance adjusters maintain a percent of the last insurance claim payment. If you are facing a huge claim with a potentially high payment, variable in the price prior to selecting to employ a public insurer.

The Single Strategy To Use For Property Damage

To vouch for this commitment, public insurers are not paid up front. Instead, they obtain a portion of the negotiation that they acquire in your place, as managed by your state's department of insurance policy. A skilled public insurance adjuster functions to achieve a number of tasks: Understand as well as examine your insurance plan Maintain your legal rights throughout your insurance coverage claim Properly as well as thoroughly examine and value the scope of the building damages Apply all policy stipulations Negotiate an optimized settlement in a reliable as well as efficient manner Dealing with a seasoned public insurance adjuster is just one of the very best ways to obtain a fast and also fair settlement on your case.

Your insurance company's agents are not always going to look to reveal all of your losses, seeing as it isn't their responsibility or in their ideal passion. Provided that your insurance business has a professional working to protect its passions, should not you do the exact his explanation same?

Nevertheless, the larger and also a lot more complex the case, the more probable it is that you'll need expert aid. Working with a public adjuster can be the ideal choice for several kinds of property insurance coverage cases, especially when the stakes are high. Public adjusters can help with a number of useful jobs when browsing your insurance claim: Interpreting plan language and also determining what is covered by your carrier Performing a thorough analysis of your insurance coverage Considering any recent changes in building ordinance as well as laws that could supersede the language of your plan Finishing a forensic analysis of the residential or commercial property damages, frequently revealing damage that can be or else hard to locate Crafting a customized plan for getting the ideal settlement from your review home insurance coverage claim Documenting as well as valuing the complete degree of your loss Assembling photo proof to sustain your insurance claim Taking care of the daily tasks that usually accompany suing, such as interacting with the insurance coverage firm, attending onsite conferences as well as sending papers Providing your cases plan, including sustaining documents, to the insurer Skillfully bargaining with your insurance policy business to guarantee the biggest negotiation possible The very best component is, a public insurance claims insurer can obtain included at any factor in the insurance claim filing procedure, from the moment a loss strikes after an insurance policy case has currently been paid or rejected.